Designing a mobile banking experience that blends function and exploration

Lloyds Banking Group (LBG)

YEAR & LENGTH: 2024 — 6 months

PROJECT: Product Design

ROLE: Product Lead

LBG brings together 16 distinct brands, including Lloyds, Halifax and Bank of Scotland, making it the UK’s largest retail and commercial bank. Yet despite this deep heritage, most of its 20 million customers interact only transactionally, mainly to track spending and savings.

How to help LBG rethink its mobile app experience to drive deeper engagement, encourage product discovery, and give customers a more holistic view of their financial ecosystem while positioning the bank as a life‑long financial advisor?

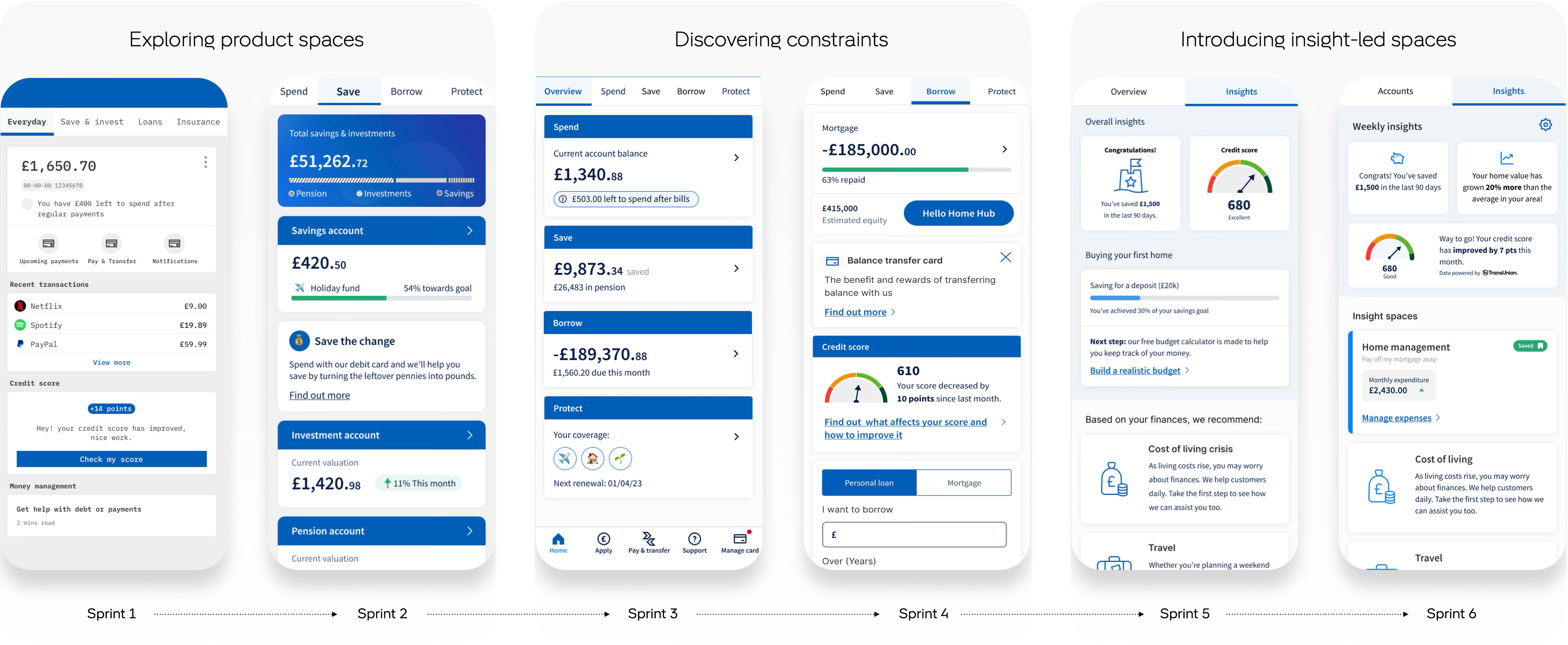

An iterative journey to evolve the solutions over 6 design and research sprints

We started off with workshops to understand the problem space and what the strategic direction entailed, and leveraged the sprints to explore designs while answering key research questions about LBG customers. We worked alongside LBG in ideation and prioritisation sessions to recalibrate and pivot the designs to meet customer needs.

Project goals

- Develop the most effective banking app real-estate to facilitate usability and utility

- Improve the discoverability of new products and features

- Drive deeper engagement through tailored and personalised experiences

- Provide customers with a more holistic understanding of their financial ecosystem

Research questions

- What value do people derive from an overview page?

- What drives people’s preference for a landing page?

- Which financial “spaces” best match customers’ mental models of managing money?

- What is the right moment to leverage upsell?

User flows

- I want to buy a home

- I want to buy a car

- I want to save for my family

- I want to plan my retirement

Gauge initial appetite for spaces as a categorisation

Pressure test the spaces with a full set of products within each space

Test where participants want to land, and how they prefer to navigate

Cater spaces to key customer populations to test its adaptability

Prioritise balancing discoverability and utility for LBG customers with limited accounts

Expanding to customers with more accounts

“These different sections make sense to me. Even if I don’t have a loan, I know where to go to find one in the future.”

Sprint 1 participant

“The order of the grouping makes sense—to move from spend to save to borrow to protect.”

Sprint 2 participant

“I like the headline figures that you see on the overview. It’s only one click to see the details.”

Sprint 3 participant

“I often transfer money between accounts, so I want to see it all in one view.”

Sprint 4 participant

“Accounts vs. insights is like separating the practical and theoretical— having it side by side really makes it easy to navigate.”

Sprint 5 participant

“I like that the insights are available when you need them, without pushing products. Everything is easy to find.“

Sprint 6 participant

Pivoting the design direction

Throughout the course of the 6-month engagement, we tested 16 prototypes across 65 hours of research to deliver a new design direction alongside a deeper understanding of LBG customers.

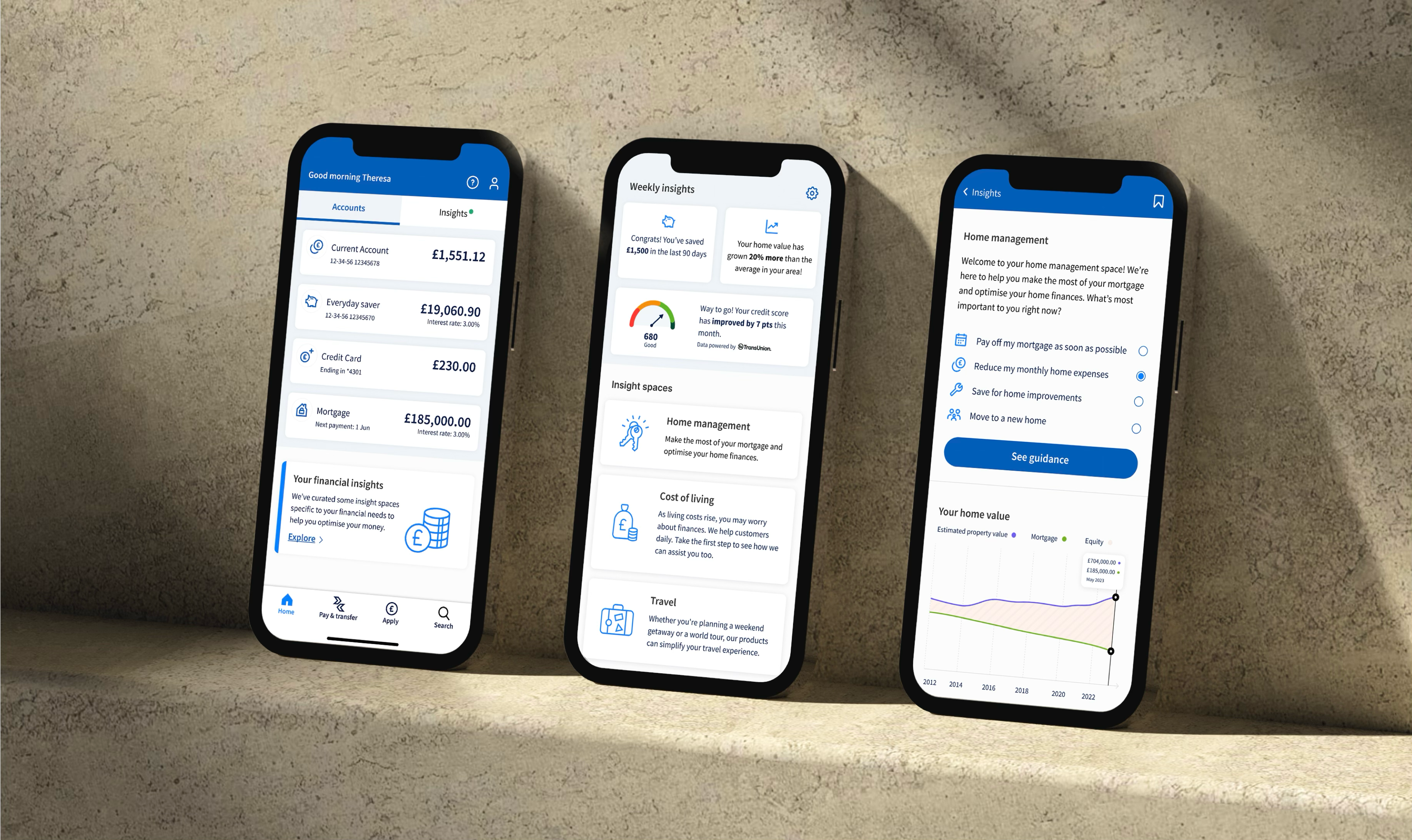

Elevating product discovery while enabling core banking functions.

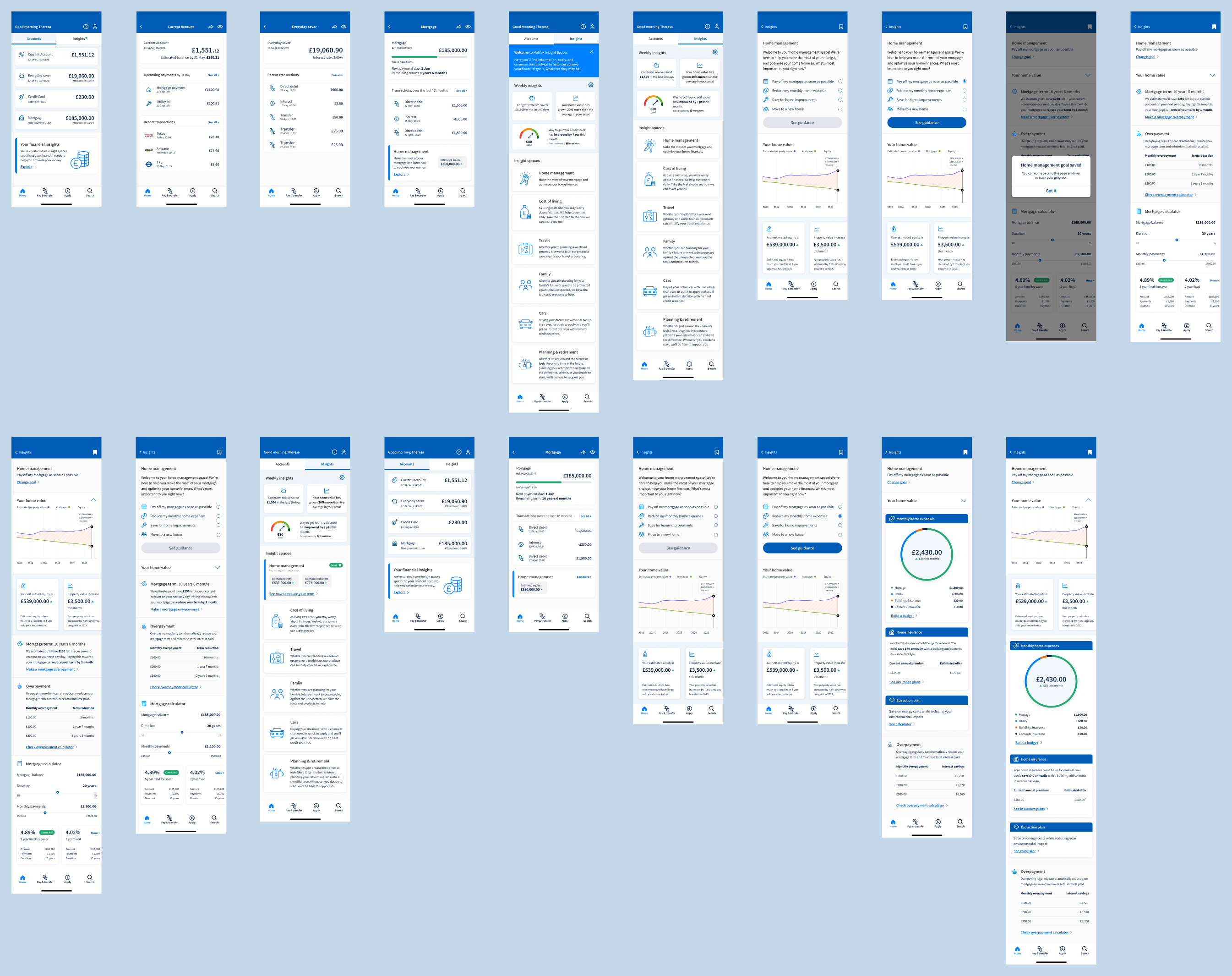

Through our research, we discovered that customers engage with their mobile banking apps in two distinct mindsets — one for day-to-day utility (e.g., checking transactions, making payments), and one for planning and exploring. The key to building a deeper engagement and a trusted relationship lies in expediting the former, and driving insight and empowerment in the latter.

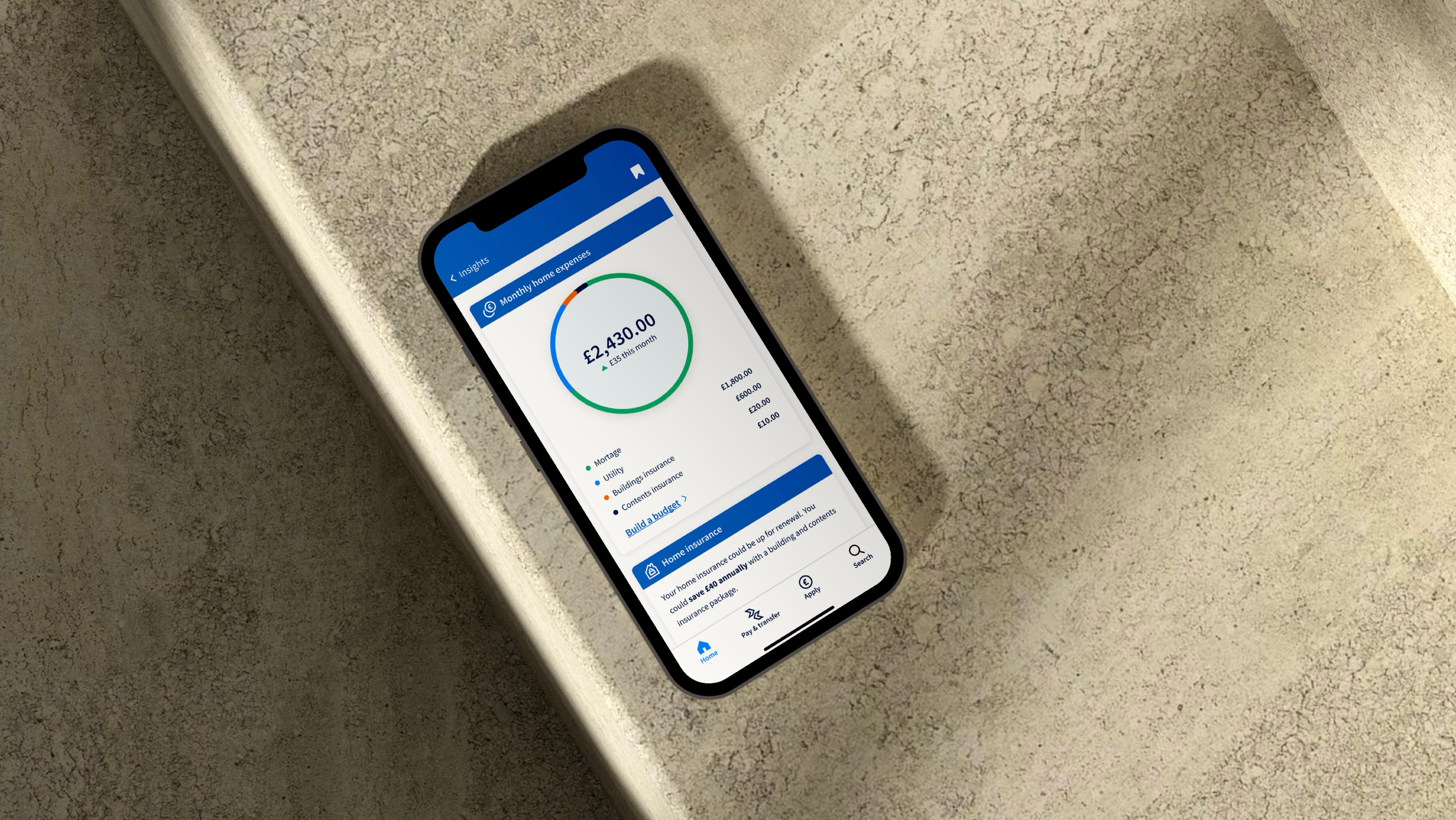

We designed a mobile home experience that couples a streamlined accounts page with an insights page. The insights are catered to varied priorities in customers’ financial lives (e.g., home management, cost of living, planning for retirement), allowing them to define the right goals that they’d like LBG to advise on. When customers are prompted with insights about their money, and advice on how to improve their financial well-being, they are more open to exploring additional support and products from the bank.

Research findings around banking behaviours

- Core banking behaviours are driven by utility, habit, and a desire for security

- Adopting new banking providers is driven by chasing the best deal, and avoiding bad experiences

- Increasingly complex personal finances require special tools to gain an overview

- Mobile banking apps currently play a minimal role in researching and adopting new products

Accounts: a place for security and utility

Insights: a place for exploration and discovery

Design Principles

We have developed a comprehensive set of design principles that serves as a guiding framework for our research and design explorations. These principles encapsulate LBG’s unique vision, goals, and values, ensuring a consistent and impactful user experience across its products and services.

SUPPORT THE TWO-MONEY MINDSET

Day-to-day banking utility and planning for the future represent distinct headspaces for customers. Creating dedicated space for both of these helps target different engagement models with customers.

BALANCE PERSONALISATION WITH AUTONOMY

Untangling finances for customers requires a two-pronged approach of tailoring content to the right level of understanding and allowing them to take the driver’s seat to direct what serves them best.

EMPOWER STRATEGIC DECISION-MAKING

To engage customers beyond a tactical level, LBG needs to catalyse customers’ financial decision-making. Tools and insights that help customers track how they’re staying afloat or growing their wealth go a long way in positioning LBG as a financial advisor.

PROMOTE A SYMBIOTIC EXCHANGE

Further, the relationship of trust by offering customers financial insight in exchange for entertaining potential new offerings. Showcase how these can add value to their lives and nurture their financial well-being.

FOSTER A TRUSTED RELATIONSHIP

Customers may trust their money with LBG, but that trust doesn’t yet extend to their financial well-being. Promoting transparency and creating pathways that align LBG with customers’ existing goals helps to grow that relationship.

Meaningful impact

These 6 sprints established the core foundations of Lloyds’ current banking app, enabling a tailored experience that gives customers clearer insight into their financial lives.

4.8

stars on the Apple App Store

4.7

stars on the Google Play Store

“I’m so impressed with the work you’ve done. The project has been incredibly fast-paced. We have wanted to do this for 2.5 years, and in 6 months we’ve reached the best solution possible. Not only a design I really believe in, but also supporting us with all the internal politics.”

Senior Product Owner at LBG

PRODUCT LEAD

Elphège Barthe

SERVICE DESIGNER

Jen Zhao

UX DESIGNER

Matthew Byrne

RESEARCHER

Finn Fullarton Pegg